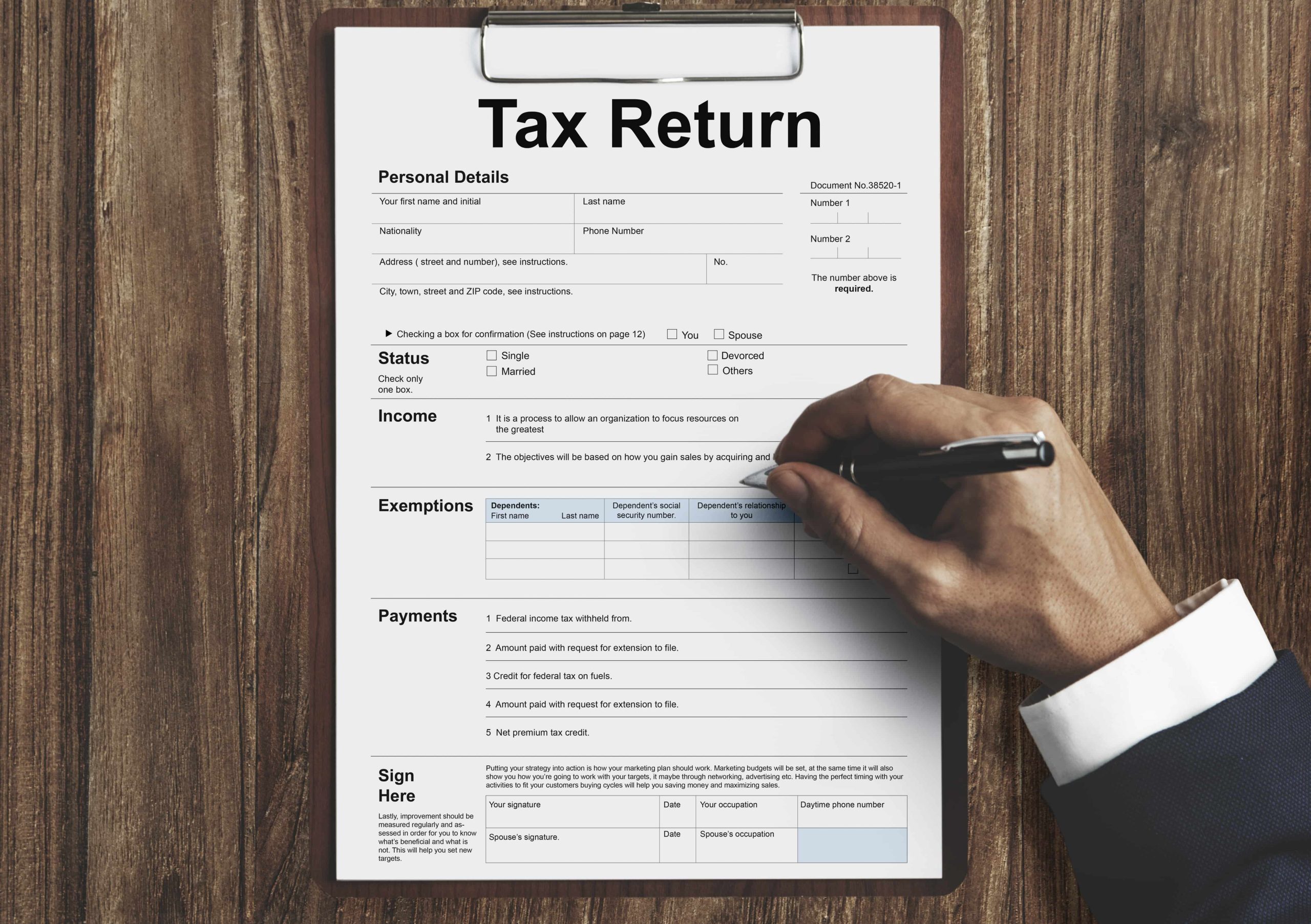

SELF - EMPLOYED RETURN

The Self-Employed Return is a tax document filed by individuals who work for themselves and operate their own businesses or freelance activities. As self-employed individuals, they are responsible for reporting their business income, expenses, and other relevant financial information for a specific tax year. This return typically includes details about gross income earned from their business activities, deductions for business-related expenses (e.g., supplies, equipment, home office expenses), and any other eligible deductions or credits. Self-employed taxpayers may also need to pay self-employment taxes, which consist of both the employer and employee portions of Social Security and Medicare taxes. Filing a self-employed return requires careful record-keeping and adherence to tax regulations to accurately report income and claim appropriate deductions, ensuring compliance with tax laws and optimizing tax liabilities. Seeking assistance from tax professionals or using specialized tax software is common for self-employed individuals to navigate the complexities of their tax obligations effectively.